Connecting Sage Accounting

Sage provides accounting software which MotorDesk connects with to automate your accounting processes. MotorDesk's integration with Sage offers what we call live synchronisation - typically after creating or editing an invoice in MotorDesk you can expect the invoice to have been created or edited in Sage within a few seconds.

Connecting Sage

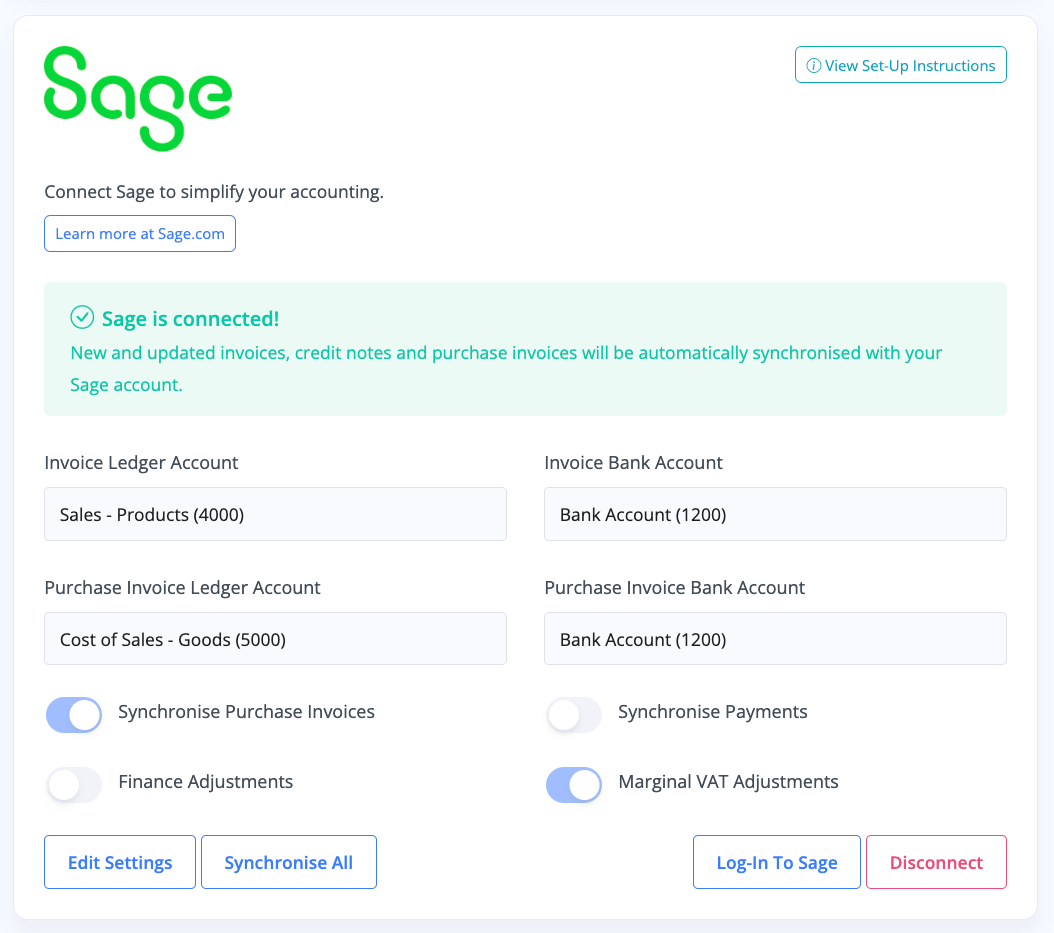

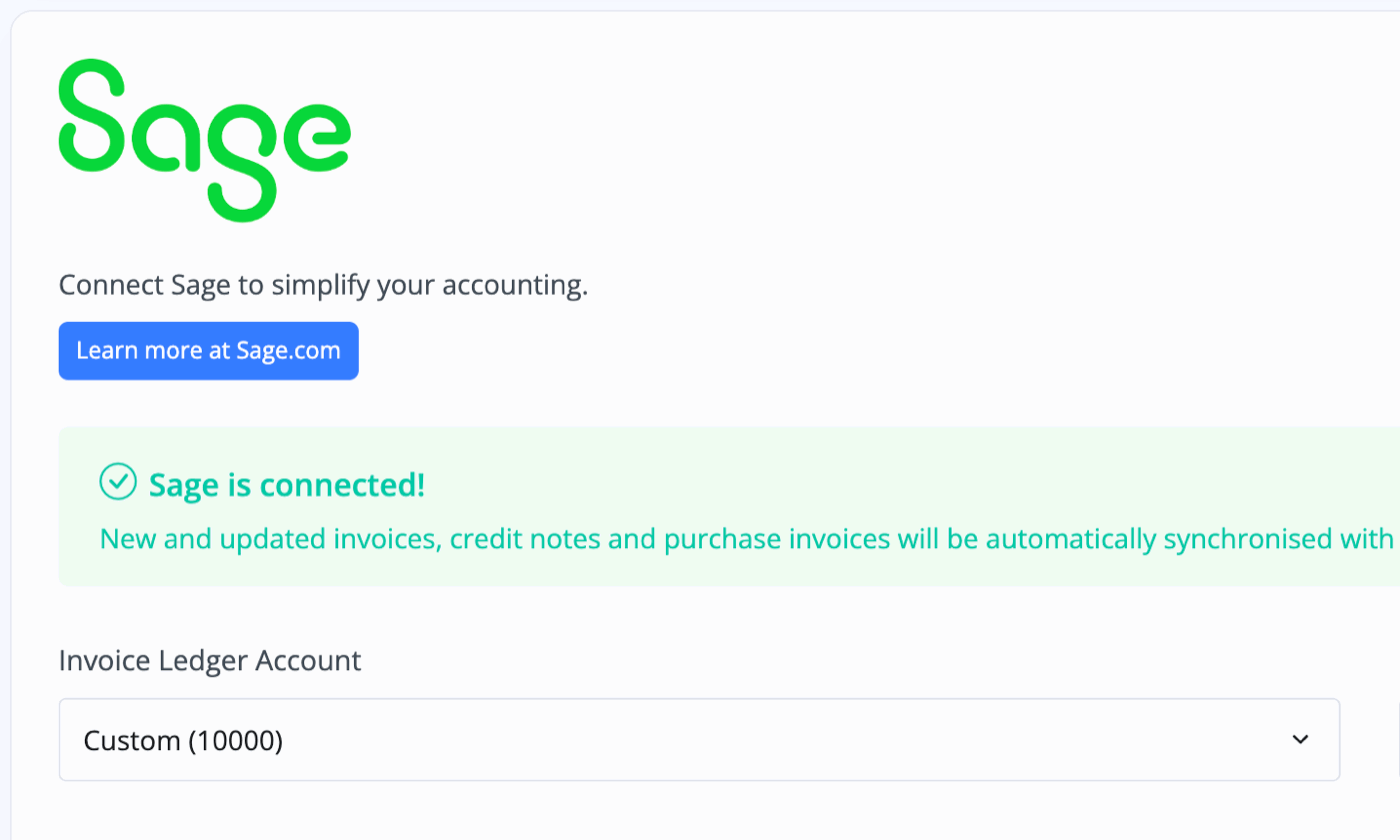

To connect your Sage account, simply go to the Business -> Connect Services -> Accounting section, then select the 'Connect Sage' button and follow the process to authorise the connection.

Once connected, you can choose to 'Synchronise All' existing invoices, this feature should be used with caution but it does enable you to restore your accounting data with ease and even switch between accounting software.

Sage Account Codes

MotorDesk uses Sage account codes, these can be configured in Sage as required.

When you add or edit account codes in Sage please go to the Business -> Connect Services -> Accounting section in MotorDesk and select the Sage 'Edit Settings' button, this will provoke MotorDesk to retrieve your current Sage account codes which will then be available to select in the 'Options' section when creating and editing invoices and purchase invoices, and also when creating and editing contacts.

Connection Options

In the Business -> Connect Services -> Accounting section of MotorDesk, you can customise how MotorDesk interacts with Sage.

Synchronise Purchase Invoices controls whether purchase invoices will be synchronised.

Synchronise Payments controls whether invoices should be marked as paid in Sage when they are marked as paid in MotorDesk - we advise against this option as proper bank reconciliation will provide a more robust accounting process.

Finance Adjustments controls whether finance amounts should be sent to Sage. These can be excluded when you have separate invoices for the finance payments, such as the Finance Provider Invoices generated by MotorDesk.

Marginal VAT Adjustments controls whether MotorDesk should adjust your invoices for marginal VAT automatically. When enabled, marginal VAT invoices will have two invoice lines for each vehicle sold, enabling VAT to be applied on the profit, leaving the purchase value without VAT. For this to work correctly you must ensure you accurately record your vehicle purchase prices, and to comply with the marginal VAT second-hand goods scheme you must ensure the customer is only provided with the MotorDesk invoice, and not the Sage invoice. When enabled additional notes are added to the Sage invoice to clarify why the invoice is being created in this way, and to provide a paper trail to the MotorDesk sales invoice.

Managing Customers/Contacts

All customers and contacts created in MotorDesk should be managed from MotorDesk, and it is important you do not remove customers from Sage which have been created by MotorDesk.

How To Set-Up Accounting/Nominal Codes

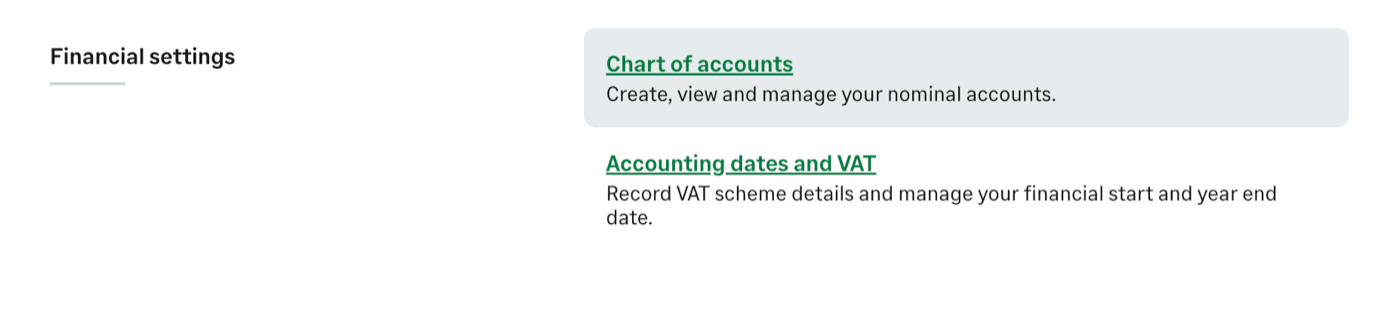

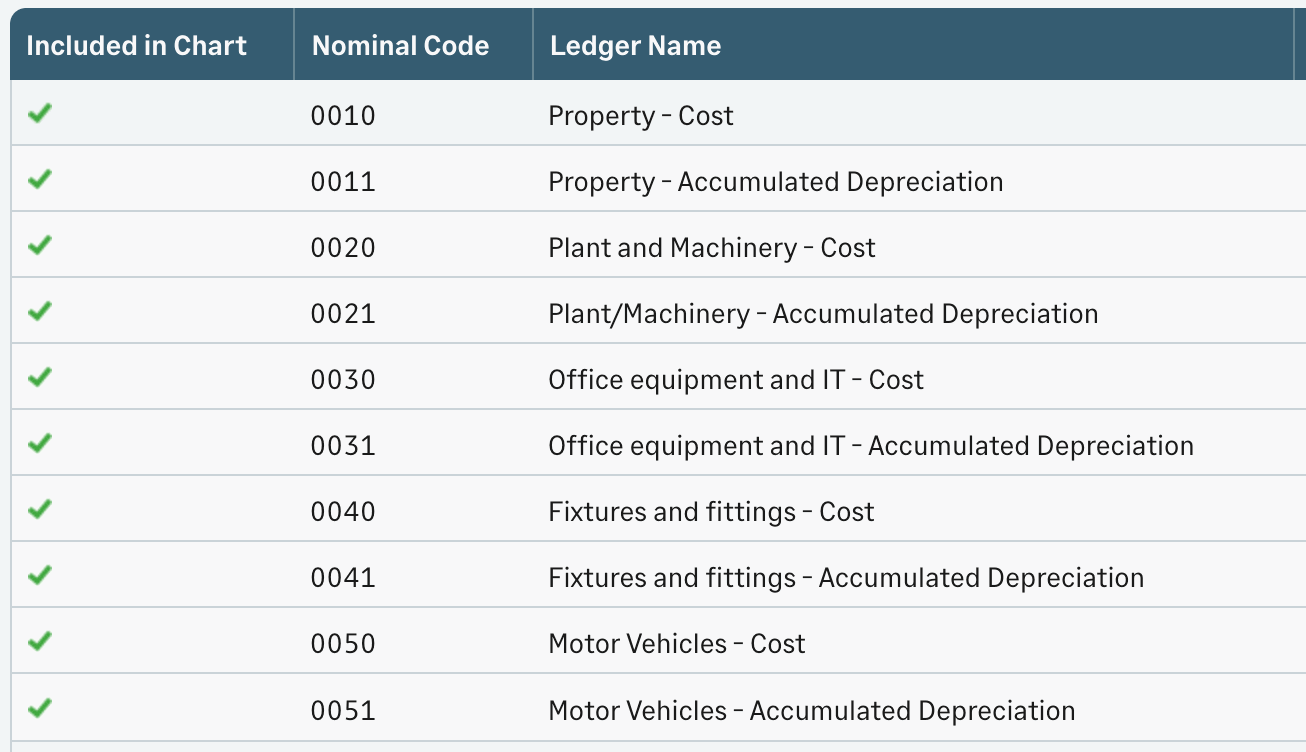

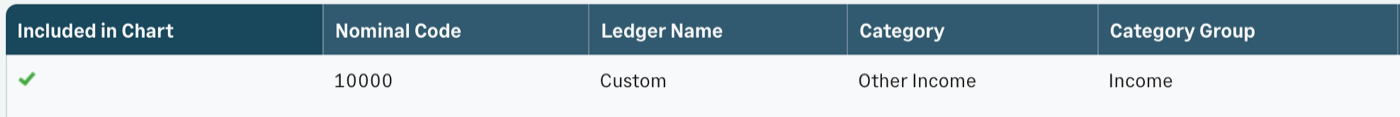

Under 'Business Settings' in your Sage account, click on 'Chart Of Accounts' to see your various accounts and their accompanying nominal codes.

You can choose where various Invoices, Costs & Products are recorded in Sage by assigning your preferred nominal code in MotorDesk.

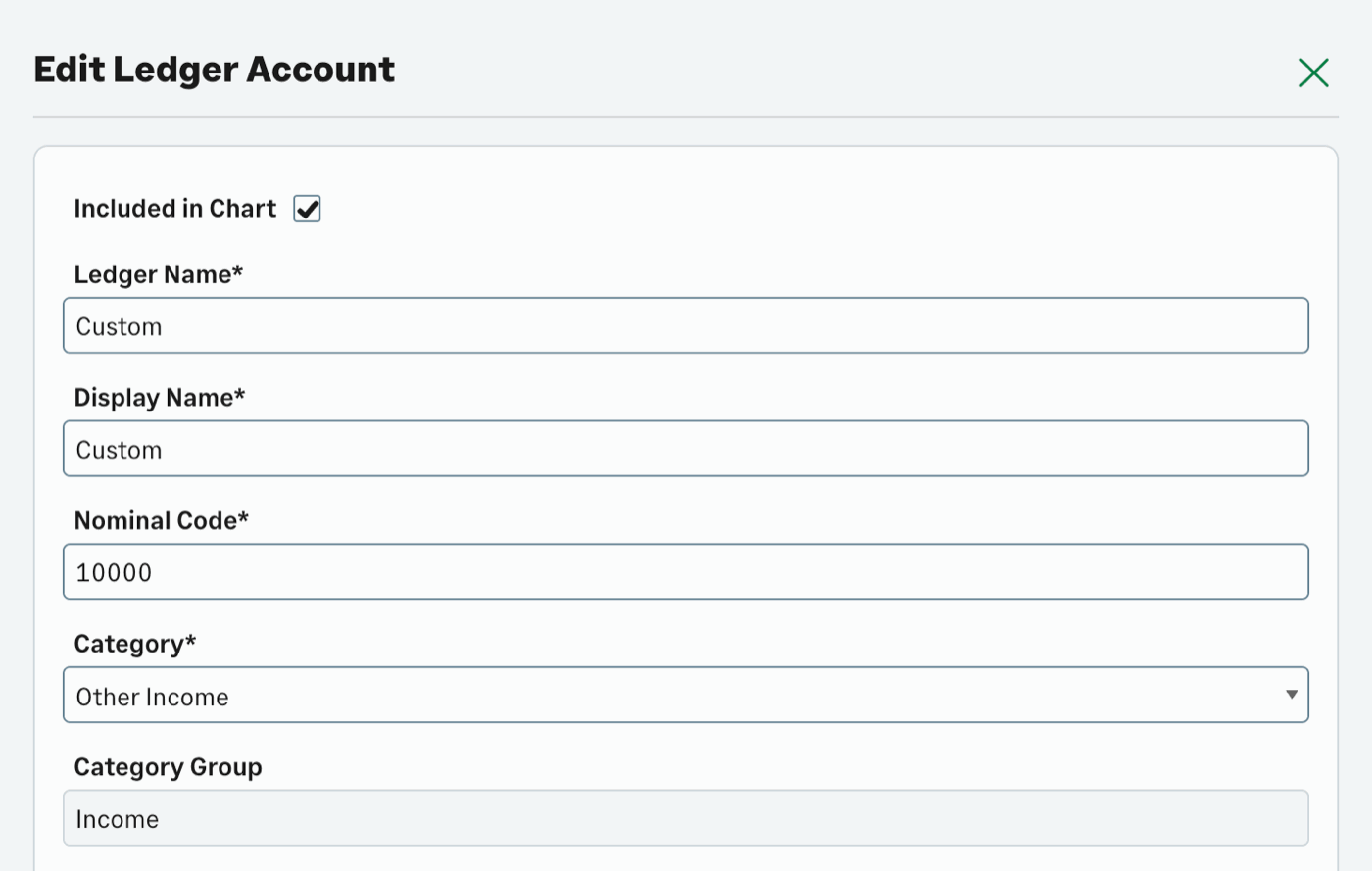

You can select 'New Ledger Account' to create your own custom accounts, which can subsequently be selected as the code which links certain invoices or items to this category in Sage.

After adding new codes in Sage, please go to the Business -> Connect Services -> Accounting section and select 'Edit Settings' to trigger MotorDesk to retrieve your latest codes. Only nominal codes supported by MotorDesk will be available for selection. If your code does not appear when selecting Edit Settings, it means that type is not supported.

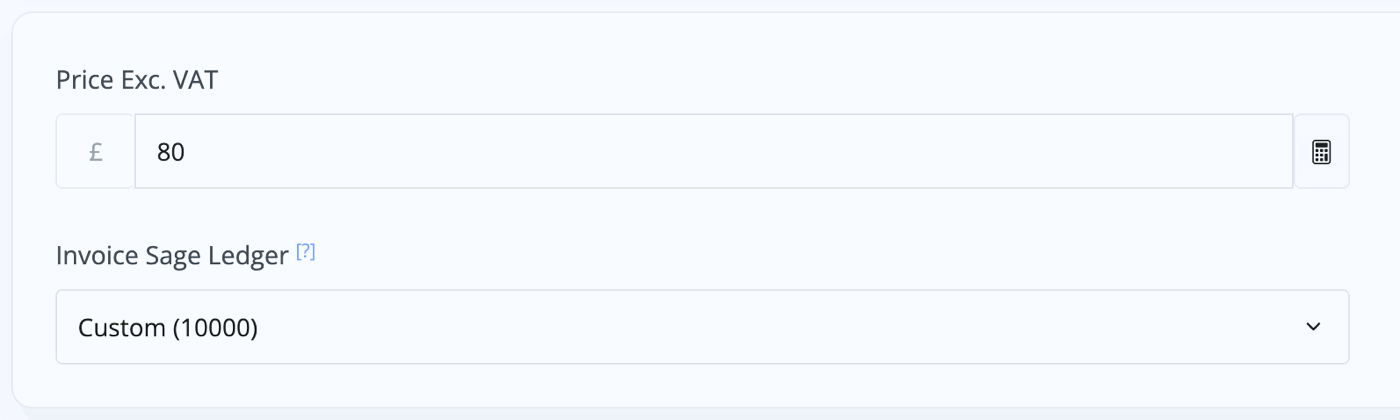

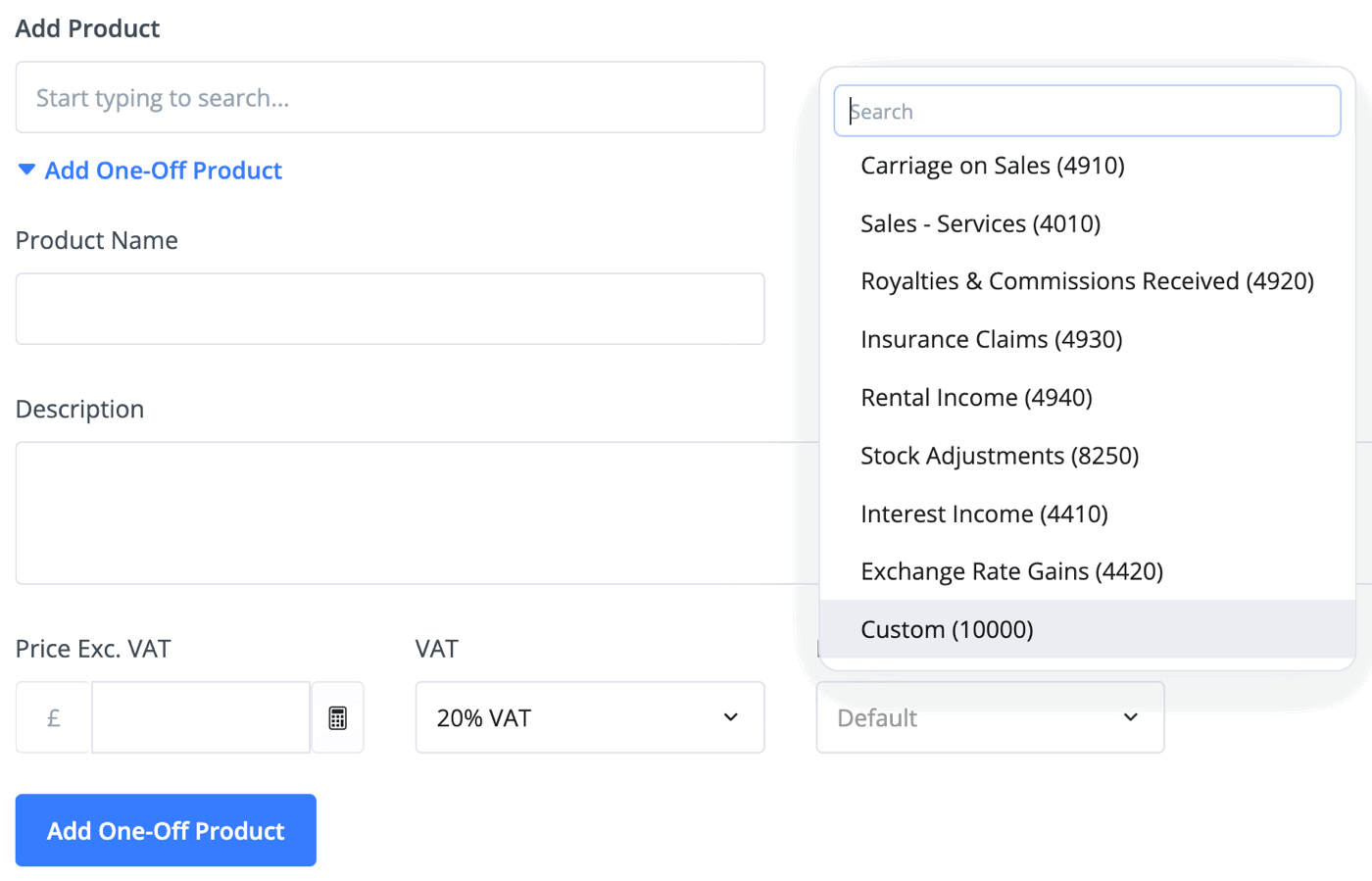

In addition to these defaults, you can link any product in your product library to any nominal code in Sage when adding a product to your Product Library in MotorDesk.

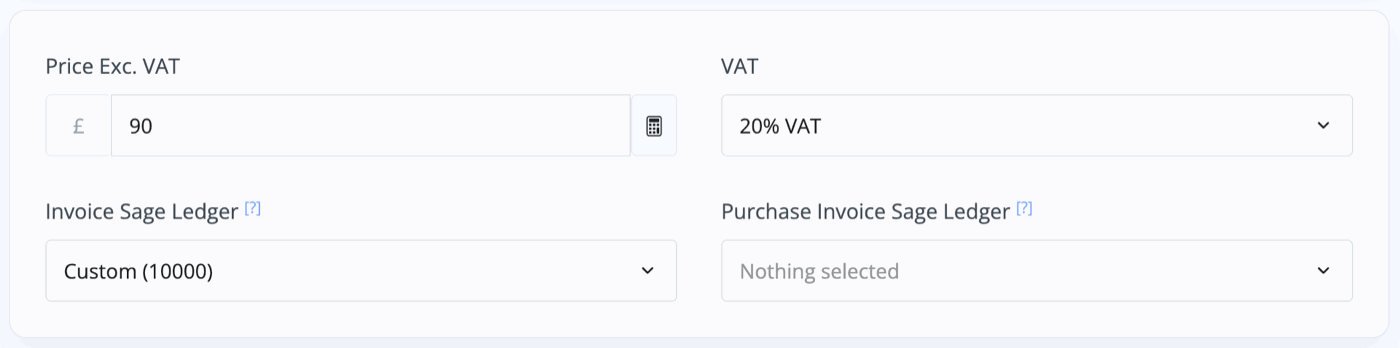

When creating any type of invoice, you can add any of the nominal codes you have in Sage to any product or additional cost included that you add to the invoice. In theory, every product on the invoice can have a different nominal code.

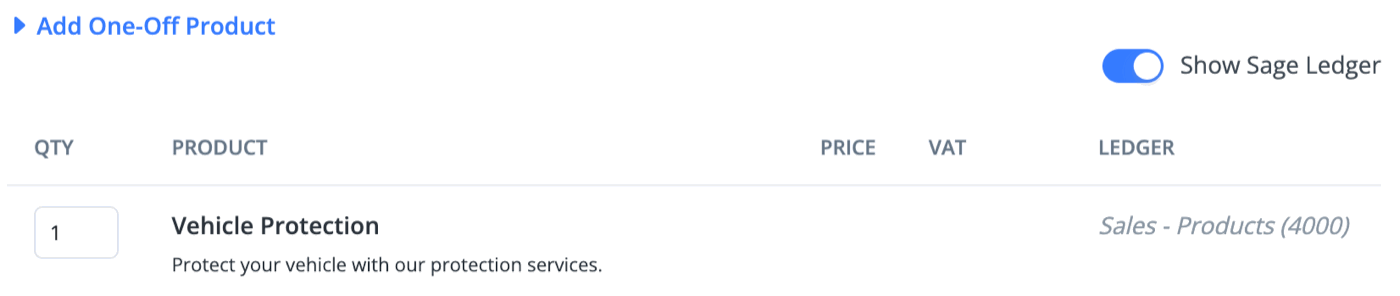

There is a toggle available to view the ledger of nominal codes.

Related Documentation

Set-Up Guidance

- Accounting/Nominal Codes

- Connecting Aircall

- Connecting AutoTrader

- Connecting Bird Messaging (NEW)

- Connecting Bird Messaging (OLD)

- Connecting Intuit QuickBooks

- Connecting MessageBird

- Connecting RingCentral

- Connecting Sage Accounting

- Connecting Stripe

- Connecting takepayments

- Connecting Third-Party Websites

- Connecting Xero

- Creating Your Business Account

- Getting Started Guide

- Online Checkout & Deal Builder Set-Up

- Sales Channels & Marketplaces

- Set-Up Bing Webmaster Tools

- Set-Up Facebook Site Verification

- Set-Up Facebook/Meta Catalogue & Automotive Ads

- Set-Up Google Ads and Facebook Pixel Conversion Tracking

- Set-Up Google Analytics

- Set-Up Google Search Console

- Set-Up Google Tag Manager

- Set-Up Google Vehicle Ads

- Set-Up Meta Pixel (Facebook Pixel)

- Set-Up Vehicle Image Background Removal

- Set-Up Vehicle Image Branding

- Set-Up Vehicle Image Library

- Set-Up Vehicle Image Templates

- Synchronising External Calendar Software/App

- Transferring Your Domain